Undoing HEx's spell

There are better tools to solve the 'affordability' problem than a 20% homestead exemption (HEx). Here's what progressive, fiscally-responsible Austinites must argue.

"It's just a tax cut for mansions."

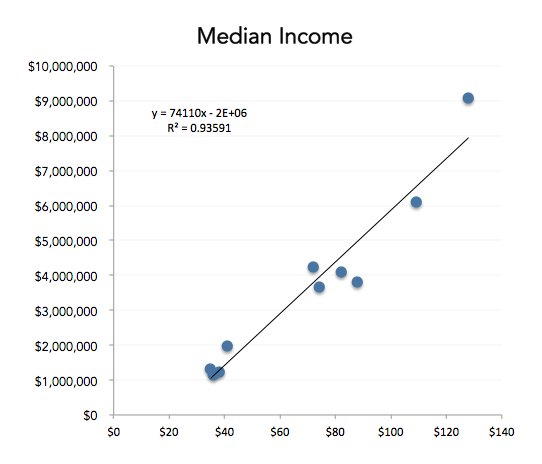

The benefits of a percentage-based homestead exemption disproportionately flow to those with the most property wealth and income. The chart below …

[MORE]