City Budget Day 2015

The most important policy themes going into the adoption of the new City budget.

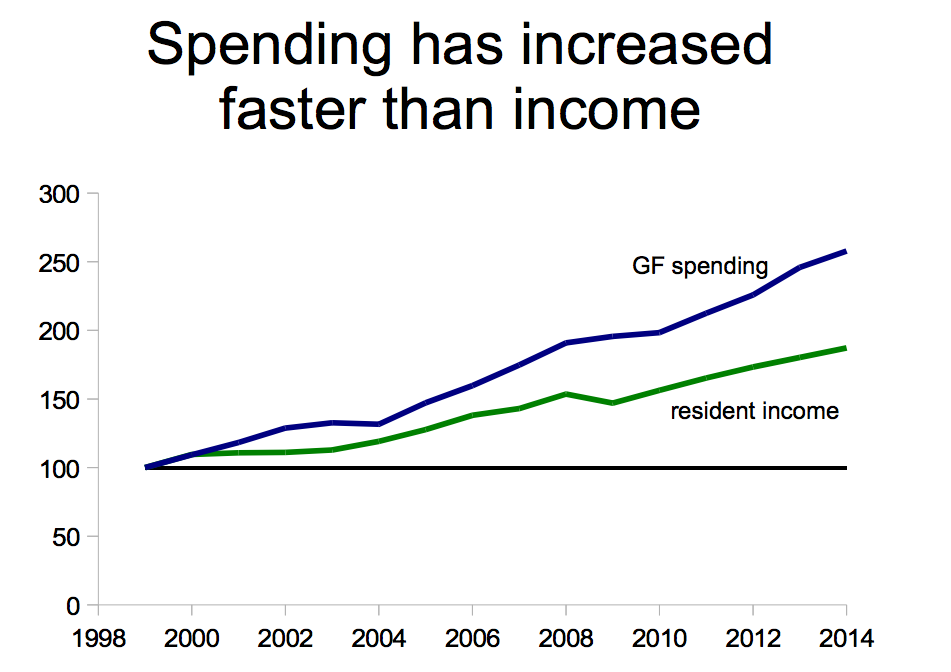

The City’s general fund spending has increased faster than resident income.

1. Growth Dividend? The City's revenue generation approach is about to start a multi-year march towards a more regressive state as a result of …

[MORE]